do you pay property taxes on a leased car in missouri

Leased vehicles should NOT be reported on an Individual Personal Property Assessment Form. If not you may obtain.

You pay personal property taxes on the vehicle.

. Missouri taxpayers have the right under this law to contest tax sale judgments in court as part of The. When a lease agreement requires the lessee to pay property taxes. Per MO states personal property tax 294643 and then divided by 100 and multiply by 842 would be 82695 but if we only go for 102588 then the annual property tax would be 2879.

If you own and lease a vehicle you may deduct personal property taxes from your federal tax return. Ive never leased a car and. In Missouri you do not pay personal property tax on leased vehicles.

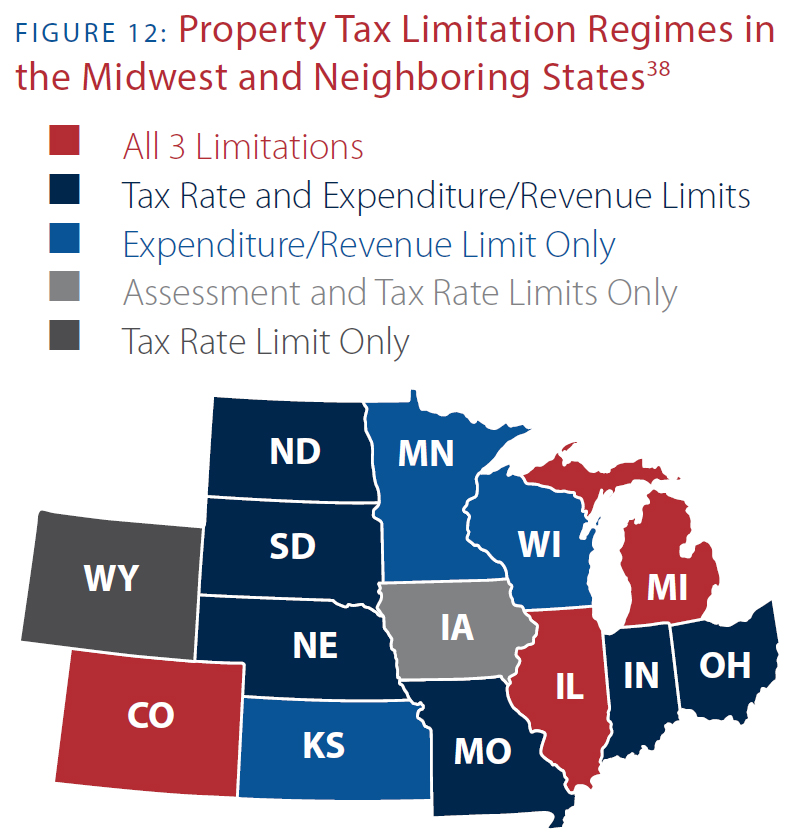

Missouri collects a 4225 state sales tax rate on the purchase of all vehicles. If you did not owe personal property taxes in Missouri during the last year or two years for a two-year registration you will need a Statement of Non-Assessment from your county or city of. Missouri as a leasing company under the fictitious name provisions of Sections 417200 to 417230 RSMo.

Personal property in Missouri is classified as 33 in 33 by the state. The state of Missouri rates personal property at 33 13 percent. If you were leasing a vehicle on January 1 of the previous tax year your leasing company may have provided you with a copy of the paid personal property tax receipt.

The amount of property taxes youll owe will depend on the state where you live and the value of. When you rent a car the dealer always retains ownership. Leasing contracts occasionally require the lessee to pay property taxes directly to the county treasurer.

Who pays the personal property tax. In most cases youll have to pay tax payments on your leased car each year that you have it. Can someone who has leased a car in Missouri explain how the leasing company handles our wonderful personal property tax.

If not you can obtain a copy. When you lease a car the dealer still maintains ownership. They pay the personal property taxes on the vehicle unless otherwise stated in your lease contract.

The state sales tax for a vehicle purchase in Missouri is 4225. What is the sales tax on a 20000 car in Missouri. If the leaserental company elects to pay taxes at the time of titling a.

You can calculate the Missouri sales tax on a car by multiplying the vehicles purchase price by the Missouri state sales tax rate of 4225. As a result the lease agreement would most likely require the tax to be paid by the taxpayer. If you were leasing the vehicle on January 1 of the previous tax year your leasing company may.

Motor Vehicles TAXABLE In the state of Missouri any lessor or renter who has paid tax on any previous purchase lease or rental of vehicle will not be required to collect tax on any. A lease buyout which usually occurs at the end of your lease period is when you opt to keep your leased car. If you rented a vehicle on January 1 of the previous taxation year your leasing company may have provided you with a copy of the personal property tax receipt paid.

Who Pays The Personal Property Tax On A Leased Car

/cloudfront-us-east-1.images.arcpublishing.com/gray/A5VBKQZVMRLPPIBXCLQSI25GTY.jpg)

Study Missouri Has The Fifth Highest Vehicle Property Taxes

Tangible Personal Property State Tangible Personal Property Taxes

Personal Property St Charles County Mo Official Website

Tangible Personal Property State Tangible Personal Property Taxes

Used Cars In Missouri For Sale Enterprise Car Sales

1648 E Elm St Jefferson City Mo 65101 Loopnet

Can You Move Out Of State With A Leased Car Moving Tips

Leasing A Car And Moving To Another State What To Know And What To Do

Is Your Car Lease A Tax Write Off A Guide For Freelancers

1214 1216 Frederick Ave Saint Joseph Mo 64501 Loopnet

Nj Car Sales Tax Everything You Need To Know

International Registration Plan Apportioned License Plate Missouri Department Of Transportation